ssa.gov Social Security Payment Schedule (Dates) for 2024 Direct Deposit, Increase, Payments Calculator. SSI Direct Deposit Date Change Notice Check.

Social Security Payment Schedule 2024

In 2024, Social Security benefits and Supplemental Security Income (SSI) payments have increased by 3.2%. This adjustment, known as the annual cost-of-living adjustment (COLA), is mandated by law. Federal benefits rise due to the rise in the cost of living, as measured by the Department of Labor’s Consumer Price Index for Urban Wage Earners and Clerical Workers.

Benefits of Social Security benefits and Supplemental Security Income (SSI) :

For adults (age 18 and over):

i. Retirement

ii. Disability

iii. Social Security Disability Insurance

iv. Supplemental Security Income for Disability

v. Spousal support with children in care

For children (under age 18):

i. Survivor benefits

ii. Lump Sum Death Payment

iii. Monthly benefits for children whose parent(s) died

iv. Disability

v. Supplemental Security Income for Disability

Maximum Federal Supplemental Security Income (SSI)amounts for 2024 :

| Recipient | Unrounded Annual Amounts : 2023 – 2024 | |

|---|---|---|

| Eligible Individual | $10,970.44 – $11,321.49 | |

| Eligible Couple | $16,453.84 – $16,980.36 | |

| Essential Person | $5,497.80 – $5,673.73 | |

| Recipient | Monthly Amounts for 2024 |

|---|---|

| Eligible Individual | $943 |

| Eligible Couple | $1,415 |

| Essential Person | $472 |

Planning for Retirement :

- You can apply for your monthly retirement benefit anytime between ages 62 and 70. The amount you receive is calculated based on your lifetime earnings, with higher payments the longer you wait to apply, up until age 70.

- Use your Social Security account to estimate your benefit amount at different ages between 62 and 70.

- Factors affecting your benefit amount include healthcare costs, Medicare enrollment at age 65, taxes on benefits, and the option to continue working after reaching Full Retirement Age.

- Your Full Retirement Age falls between 66 and 67, and delaying benefits beyond this age can increase your payment.

- Consider the timing of your first benefit payment to avoid income gaps by applying up to four months before the desired start month.

- If you’re eligible based on a spouse’s work, the benefit amount peaks at your Full Retirement Age, but doesn’t increase by waiting beyond that.

- Special considerations apply for individuals with pensions from government jobs or work abroad without Social Security taxes, and specific types of earnings like farm, government, military, railroad, or self-employment income.

Survivors Benefits Overview :

- Survivors benefits are available to family members of a deceased worker who was paying into Social Security.

- Eligible family members include spouses, children, and parents, based on the earnings of the deceased worker.

- To apply for survivors benefits, you must notify Social Security promptly of the death. This can be done by the funeral home or by calling Social Security directly.

- If you are not currently receiving benefits, it’s important to apply promptly as benefits may not be retroactive.

- If you are already receiving benefits on your spouse’s or parent’s record, you generally won’t need to file a separate application for survivors benefits.

- However, if you are receiving retirement or disability benefits on your own record, you will need to apply separately for survivors benefits.

- Documents required for application may vary depending on the type of benefit you are applying for, such as widows/widowers benefits, child’s benefits, or lump-sum death payment.

- If you don’t have all the necessary documents, your local Social Security office can assist in obtaining them, often at no cost.

- When mailing documents to Social Security, ensure the Social Security number is included separately from the original documents to facilitate processing.

Benefits for Same-Sex Couples :

A. Determining Entitlement :

- Marital status is crucial for determining entitlement to retirement, survivors, Medicare, and disability benefits.

- Marriage or legal partnerships can affect benefits eligibility and payment amounts for spouses and children.

- Non-marital legal relationships like civil unions or domestic partnerships may also entitle individuals to benefits as married persons in some cases.

B. Survivors Benefits for Same-Sex Partners and Spouses :

- Surviving same-sex partners/spouses previously excluded from Social Security survivors benefits may now qualify

- Qualification criteria include situations where marriage would have occurred if not for unconstitutional state laws.

C. Informing Social Security of Changes :

- Notify Social Security of changes in marital status or non-marital legal relationships.

- Changes could impact entitlement to benefits or SSI eligibility/payment amounts.

- Report name changes to ensure accurate earnings recording and benefit receipt.

- Changes in income affecting Medicare premiums should also be reported.

D. Additional Information :

- Same-sex couples can list both parents’ names on their child’s Social Security number record with appropriate legal documentation.

- Estimate retirement benefits and explore retirement age scenarios using a my Social Security account.

- Application for survivors benefits is not available online, but individuals can apply by phone or by contacting their local Social Security office.

E. Application Process :

- Apply online for retirement, spouse’s, Medicare, disability, and SSI benefits.

- Contact Social Security by phone or visit a local office to apply for survivors benefits.

- Applicants should apply even if unsure of entitlement, and there are no penalties for denied claims or subsequent appeals.

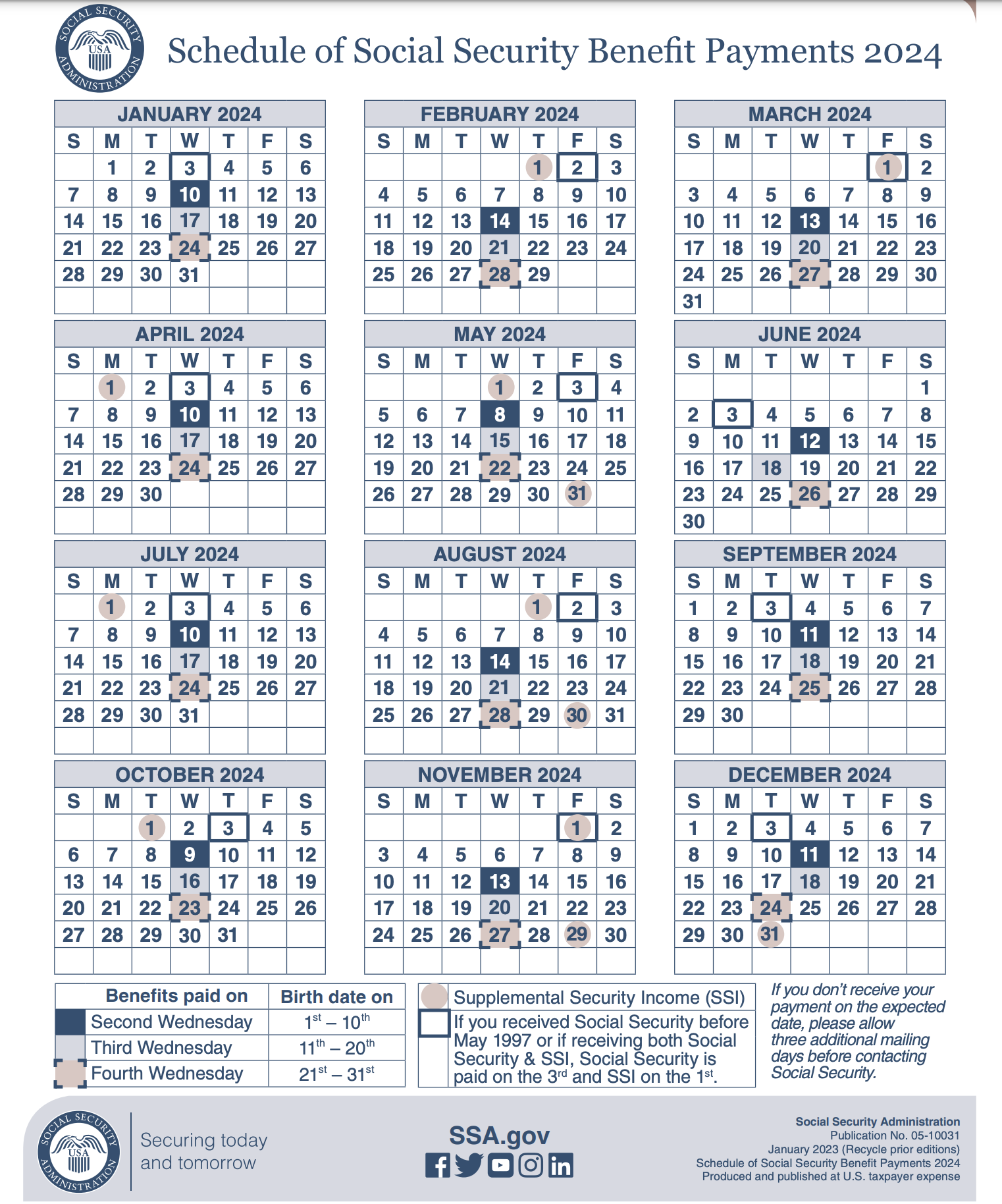

Schedule of Social Security Payments 2024 :

Restrictions of Social Security :

- Social Security payments are generally not sent to individuals in Azerbaijan, Belarus, Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan.

- Exceptions may be made for certain eligible individuals in these countries, subject to meeting and agreeing to restricted payment conditions.

- To qualify for an exception, individuals must meet specific qualifications and agree to the outlined conditions.

- For more information about these conditions and exceptions, individuals can contact Social Security or their Federal Benefits Unit (FBU).

- Contact information for assistance can be found in the last section of the publication.

- If an individual does not qualify for an exception, Social Security payments will be withheld until they leave the country with restrictions and relocate to a country where payments can be sent.

Your Right to Social Security Payments When Outside the United States :

i. If you’re a U.S. citizen, you can keep getting payments while abroad if you’re eligible and in a country where payments can be sent.

ii. If you’re not a U.S. citizen, you must meet certain conditions to keep getting payments.

iii. Being “outside the U.S.” means you’re not in the U.S. or its territories for at least 30 days in a row.

iv. If you’re not a U.S. citizen or don’t meet the conditions, payments stop after 6 months outside the U.S. They can start again after you’ve been back in the U.S. for a full month.

v. You might need to prove you were in the U.S. lawfully for that month.

vi. For more info, contact Social Security or your Federal Benefits Unit. Their contact details are in this publication.

Conditions for Social Security Payments Outside the United States :

1. Eligibility Requirements :

- Must be eligible for Social Security benefits and reside in a country where payments can be sent.

- Non-U.S. citizens must meet specific conditions to continue receiving benefits.

2. Continuation of Payments – Payments will continue if :

- Eligible for benefits since December 1956.

- Worker died in U.S. military service or due to a service-connected disability.

- Worker’s railroad work was treated as covered employment by Social Security.

- Active military or naval service of the U.S.

3. Citizens of Listed Countries (Continuation of Payments):

| Group 1 | |

|---|---|

| Austria | Japan |

| Belgium | Korea (South) |

| Brazil | Luxembourg |

| Canada | Netherlands |

| Chile | Norway |

| Czech Republic | Poland |

| Finland | Portugal |

| France | Slovak Republic |

| Germany | Slovenia |

| Greece | Spain |

| Hungary | Sweden |

| Iceland | Switzerland |

| Ireland | United Kingdom |

| Israel | Uruguay |

| Italy | |

Group-2:

| Group 2 | |

|---|---|

| Mexico | Albania |

| Micronesia, Fed. States of | Antigua and Barbuda |

| Monaco | Argentina |

| Montenegro | Australia |

| Nicaragua | Bahamas, The |

| North Macedonia | Barbados |

| Palau | Belize |

| Panamá | Bolivia |

| Perú | Bosnia-Herzegovina |

| Philippines | Bulgaria |

| Romania | Burkina Faso |

| St. Kitts and Nevis | Colombia |

| St. Lucia | Costa Rica |

| St. Vincent and the Grenadines | Côte d’Ivoire |

| Samoa | Croatia |

| San Marino | Cyprus |

| Serbia | Denmark |

| Trinidad-Tobago | Dominica |

| Turkey | Dominican Republic |

| Guyana | Ecuador |

| Jamaica | El Salvador |

| Jordan | Estonia |

| Latvia | Gabon |

| Liechtenstein | Grenada |

| Lithuania | Guatemala |

| Malta | Marshall Islands |

4. Specific Requirements for Certain Countries (Continuation of Payments) :

- Continuation of payments depends on earning credits or years of residence in the U.S.

- Conditions for dependents and survivors must also be met.

5. Residents of Countries with Social Security Agreements:

- Continuation of payments for residents of countries with U.S. social security agreements, except for Austria, Belgium, Denmark, Germany, Sweden, or Switzerland.

- Refugee or stateless persons or receiving dependent or survivor benefits under specific conditions.

List of things you must report to Social Security :

1. Change of address.

2. Working outside the United States.

3. Improvements in your disability or return to work after qualifying for disability benefits.

4. Marriage.

5. Divorce or annulment.

6. Adoption of a child.

7. Child leaving the care of a spouse or surviving spouse.

8. Child nearing age 18 becoming a full-time student or having a disability.

9. Death.

10. Inability to manage funds.

11. Deportation or removal from the United States.

12. Changes in parental circumstances.

13. Eligibility for a pension from work not covered by Social Security.

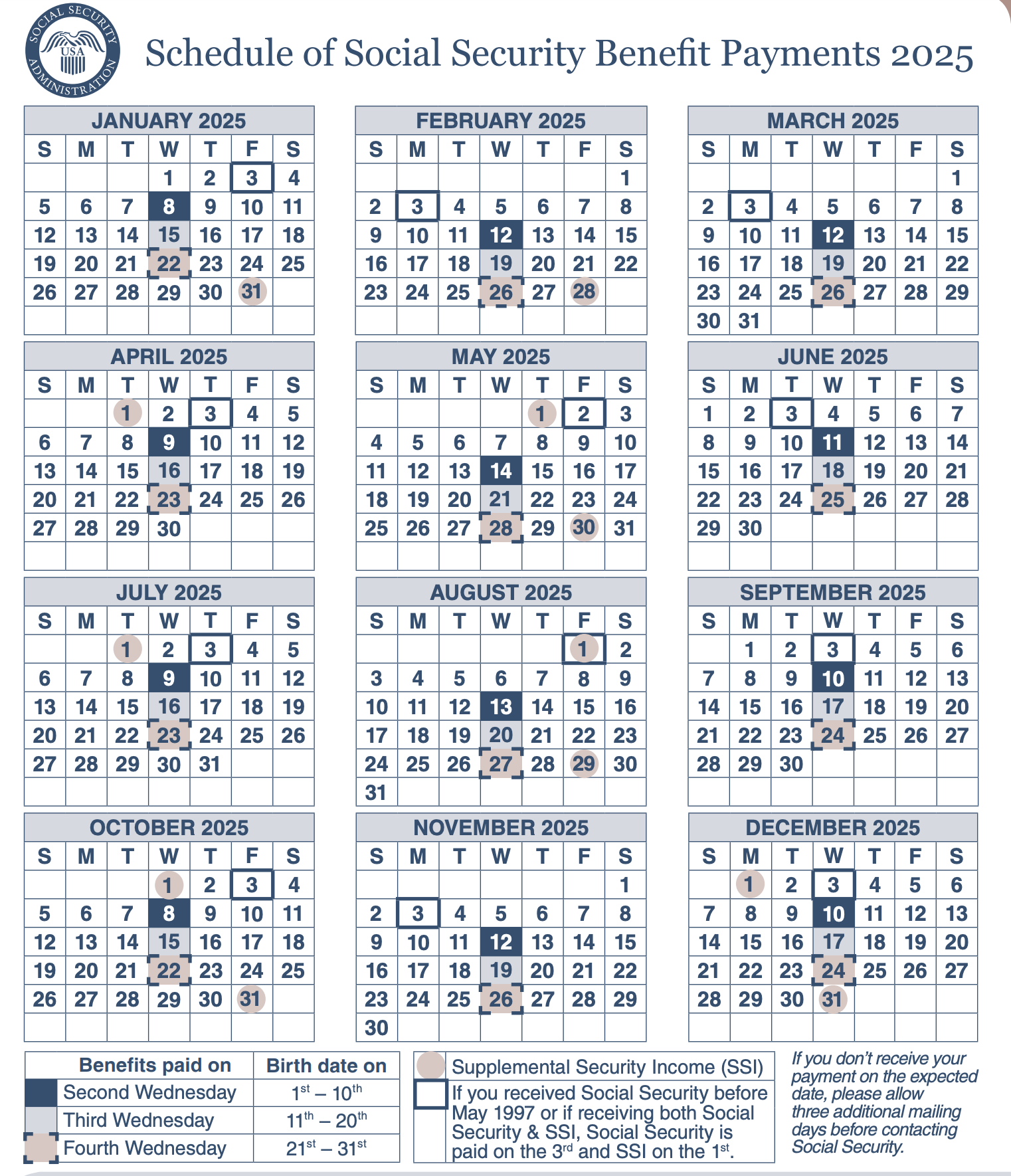

Schedule of Social Security Payments 2025 :

What if you don’t plan on collecting Social Security in 2024 ?

- You can start receiving Social Security checks at age 62.

- If you don’t plan to apply for Social Security in 2024, you could benefit in two ways.

- Waiting to claim increases your benefits.

- You can still receive Cost-of-Living Adjustment (COLA) increases even if you don’t apply until later.

- Cost-of-Living Adjustment (COLA) adjustments are included in future payments, starting at age 62.

- These adjustments continue until you start drawing your benefits.

OFFICIAL WEBSITE >> Social Security Payment Schedule 2024 >> ssa.gov

- Social Security Payment Schedule 2024

- Benefits of Social Security benefits and Supplemental Security Income (SSI) :

- Maximum Federal Supplemental Security Income (SSI)amounts for 2024 :

- Planning for Retirement :

- Survivors Benefits Overview :

- Benefits for Same-Sex Couples :

- Schedule of Social Security Payments 2024 :

- Restrictions of Social Security :

- Your Right to Social Security Payments When Outside the United States :

- Conditions for Social Security Payments Outside the United States :

- List of things you must report to Social Security :

- Schedule of Social Security Payments 2025 :

- What if you don’t plan on collecting Social Security in 2024 ?

- OFFICIAL WEBSITE >> Social Security Payment Schedule 2024 >> ssa.gov